IT Knowledgeカテゴリー記事の一覧です

What is an Automated Market Maker (AMM)?

An Automated Market Maker (AMM) is a type of decentralized exchange (DEX) that utilizes a bonding curve model, replacing the traditional order book system with liquidity pools

AMM Defination

AMMs represent a relatively recent innovation in DEXs and are now prevalent across most modern platforms. They were designed to compete with centralized exchanges by employing a passive market-making model managed through liquidity pools.

In AMMs, liquidity pools are established via smart contracts to facilitate peer-to-peer trades, enabling platforms to operate autonomously. Unlike the order book system, AMMs rely on self-executing algorithms within smart contracts to set asset prices and provide liquidity for trade execution. These smart contracts are often permissionless, allowing anyone to contribute liquidity and create their own pools.

By leveraging liquidity pools—collections of two or more assets—AMMs enable traders to execute trades on DEXs without the need to find matching bid/ask orders, ensuring continuous market availability around the clock.

DMM in stock market?

Designated Market Makers (DMMs) are responsible for maintaining fair and orderly markets for their assigned securities. They manage this task through both manual and electronic means, facilitating price discovery during market opens, closes, and times of trading imbalances or instability.

Staking Crypto vs. Yield Farming

Yield Farming Crypto: DeFi Liquidity Mining Strategies

Engaging as a liquidity provider (LP) is often the initial step in crafting a yield farming strategy. However, liquidity providers do not fully embrace yield farming until their LP tokens are optimized by being staked into multiple protocols and/or pools. Typically, liquidity miners distribute tokens across various liquidity pools and decentralized exchange (DEX) protocols.

Consider a straightforward yield farming strategy:

- Deposit CAKE and BNB into the CAKE/BNB liquidity pool on PancakeSwap.

- Obtain CAKE-BNB FLIP tokens.

- Stake CAKE-BNB FLIP tokens into the corresponding CAKE crypto liquidity pool to enhance returns.

The DeFi liquidity mining landscape is rich with such staking or farming opportunities, with new pools and protocols emerging daily. Yield farmers can stake their LP tokens across different protocols and liquidity pools for durations ranging from a few days to several months.

Staking Crypto vs. Yield Farming

Although yield farming and staking crypto are distinct practices, they are often confused with one another. Yield farming, also known as liquidity mining, involves earning rewards by utilizing cryptocurrency holdings within various DeFi protocols. In contrast, staking is primarily associated with the consensus mechanism of a Proof-of-Stake (PoS) blockchain network, where participants earn rewards as part of the network’s validation process. While staking does yield returns, these are generally lower compared to the rewards offered by DeFi yield farming protocols. Typically, staking yields range from 5% to 15% annually, whereas yield farming rates in crypto liquidity pools can surpass 100% and offer continuous payouts, allowing for withdrawals at any time.

Despite the higher potential returns, crypto yield farming comes with increased risk. For instance, on Ethereum, gas fees required to claim rewards can diminish earnings from annual percentage yields (APY). Additionally, market volatility can lead to impermanent loss, where the value of tokens in a liquidity pool decreases relative to their value on the open market. Furthermore, the reliance on smart contracts introduces the risk of vulnerabilities being exploited by hackers.

What is a liquidity pool?

A liquidity pool is essentially a blockchain-based smart contract designed to lock tokens on a decentralized exchange. The liquidity added to a pool is secured within the smart contract.

Liquidity pool is providing the necessary assets for traders to execute transactions. Liquidity providers are rewarded with a share of the trading fees paid by those who swap tokens within the pool, proportional to their contribution.

The traditional order book system works well when there are sufficient buyers and sellers in the market. However, in cases of low volume or interest, tokens may lack liquidity, making them difficult to trade. Without a market maker, a trade can quickly become illiquid.

Liquidity pools operate through trading pairs, where each pool creates a market for a specific token pair via a blockchain-generated smart contract. This system enhances the liquidity of tokens and assets traded on DeFi-based exchanges, but it requires incentives for liquidity providers to deposit assets.

The process works as follows: The initial liquidity provider sets the starting price of the assets in the pool. Providers are encouraged to deposit equal amounts according to the current price, ensuring their contributions do not impact the token’s value within the pool. In return, they receive LP tokens proportional to their deposit. When trades occur, fees are collected and distributed among LP token holders.

Price fluctuations in the pool, caused by trades, lead to changes in the supply of assets. This is managed by an algorithm known as an automated market maker (AMM), which eliminates the need for a centralized market maker or professional asset management. Traders can simply use the DEX platform to execute transactions without monitoring order books or price charts.

Furthermore, DEX platforms typically offer lower gas costs compared to centralized exchanges, thanks to the efficient design of their smart contracts.

Centralized cryptocurrency exchange (CEX) & All about its.

A centralized cryptocurrency exchange (CEX) is a business entity that functions as an intermediary, facilitating transactions between buyers and sellers of digital assets within a secure and regulated framework

Much like traditional financial systems, where centralized institutions such as banks, stock exchanges, and payment processors serve as trusted intermediaries, CEXs perform a similar role in the crypto world, providing a reliable platform for trading cryptocurrencies efficiently.

In contrast to decentralized exchanges (DEXs), which operate on a peer-to-peer basis, CEXs utilize a centralized infrastructure, where users deposit their funds and conduct trades via the exchange’s order-matching system. This centralized approach offers numerous advantages, including user-friendliness, liquidity, sophisticated trading tools, and dedicated customer support.

What are some types of CEX?

- Traditional CEX: These are the prominent centralized exchanges that have led the crypto industry for years. Examples include Coinbase, Binance, Kraken, and Bitstamp. These platforms offer an extensive array of cryptocurrencies for trading, implement strong security protocols, and adhere to regulatory standards.

- Brokerage CEX: Brokerage CEXs, such as eToro and Robinhood, cater to beginners and casual traders by providing a streamlined trading experience. These platforms often feature intuitive interfaces, educational tools, and the convenience of buying and selling cryptocurrencies with fiat currencies.

- Peer-to-Peer (P2P) CEX: Some CEXs operate on a peer-to-peer model, allowing buyers and sellers to interact directly, with the exchange serving as an escrow service. LocalBitcoins and Paxful are notable examples of P2P CEXs, enabling direct trades between individuals.

What are some benefits of a CEX:

Liquidity

CEXs often exhibit high trading volumes and deep order books, providing users with abundant liquidity. This facilitates swift and efficient trade execution, minimizing slippage and ensuring competitive pricing.

User-Friendly Interfaces

CEXs emphasize user experience by offering intuitive interfaces that cater to both beginners and seasoned traders. They frequently include advanced trading features such as market orders, limit orders, and stop-loss orders.

Security Measures

Established CEXs prioritize security by implementing stringent measures to protect user funds. These include two-factor authentication (2FA), cold storage for assets, withdrawal whitelisting, and regular security audits.

Regulatory Compliance

CEXs comply with regulatory frameworks in the regions they operate, fostering trust and offering users a sense of security when utilizing the platform.

Customer Support

CEXs typically provide customer support to help users resolve issues or answer queries promptly. This service is especially valuable for novice traders who may need guidance in navigating the platform or understanding specific features.

How does a CEX work?

Account Creation: Users begin by registering on the CEX platform, providing the necessary personal information, and completing verification processes, such as Know Your Customer (KYC) procedures.

Deposits and Wallets: Once the account is established, users deposit funds into their exchange wallets. CEXs typically offer a variety of cryptocurrency wallets for different assets supported on the platform. These wallets are managed by the exchange, allowing users to deposit and withdraw funds as needed.

Order Placement: Users can place buy or sell orders for specific cryptocurrencies on the platform. They specify the desired price and quantity, and the order is then entered into the exchange’s order book.

Order Matching: The CEX’s order matching engine pairs buy and sell orders based on price and quantity. When a suitable match is found, the trade is executed, facilitating the exchange of assets between buyer and seller.

Trade Execution: Upon trade execution, the CEX adjusts the account balances of the involved parties. The exchanged cryptocurrencies are transferred from the seller’s account to the buyer’s, and vice versa.

Withdrawals: Users can withdraw their funds by initiating a withdrawal request. The CEX processes the request, and the funds are sent to the user’s designated wallet address.

Mastering Multi Order Types in CEX

Multi order types play a crucial role in empowering traders to manage their positions effectively, optimize profits, and minimize risks. This article delves into the importance of multi order types in CEX, explores the common types available, and highlights how they can be leveraged to enhance trading strategies.

Understanding Multi Order Types in CEX

Multi order types refer to the various instructions that traders can use when placing orders on a CEX. Each order type has its own set of conditions and triggers. This allows traders to specify how and when their orders are executed. This flexibility is crucial in the competitive and volatile world of financial trading. The right order type can make the difference between a successful trade and a missed opportunity.

Common Order Types in Centralized Exchanges

Market Order

A market order is an order to buy or sell an asset immediately at the best available current price. Market orders are ideal for traders who prioritize speed and want to ensure that their orders are executed instantly. This type is commonly used in highly liquid markets where the price difference between the bid and ask is minimal. While market orders guarantee execution, they do not guarantee the price at which the order will be filled, which can lead to slippage during periods of high volatility.

Limit Order

A limit order is an order to buy or sell an asset at a specific price or better. Limit orders give traders control over the price at which they enter or exit a trade. They are particularly useful for trading assets with lower liquidity or in volatile markets where prices can fluctuate rapidly. While limit orders offer price control, they do not guarantee execution. The order will only be filled if the market reaches the specified price.

Stop Order

A stop order, also known as a stop-loss order, triggers a market order once the asset’s price reaches a specified level. Stop orders are essential for risk management, allowing traders to automatically exit positions if the market moves against them. They help protect against significant losses by ensuring that trades are closed at a predetermined level. Since stop orders turn into market orders upon activation, they may experience slippage in volatile markets, leading to execution at a slightly different price than intended.

Stop-Limit Order

A stop-limit order combines the features of stop and limit orders. It triggers a limit order once the stop price is reached. Stop-limit orders provide more control than traditional stop orders by allowing traders to specify the price range within which the order should be executed. This can be particularly useful in volatile markets. While this order type offers precision, it may result in the order not being executed if the market price moves outside the specified range before the order can be filled.

Trailing Stop Order

A trailing stop order is a dynamic stop order that adjusts with the asset’s price movement, maintaining a set distance from the current price. Trailing stops are designed to lock in profits while allowing for potential gains in a trending market. They automatically adjust to favorable price movements while limiting downside risk. Trailing stops may trigger prematurely in highly volatile markets, potentially closing a trade before it can achieve its full profit potential.

Fill or Kill (FOK) Order

An FOK order instructs the broker to execute the entire order immediately or cancel it entirely. FOK orders are used when traders want to ensure full execution at a specific price or no execution at all. They are often used in fast-moving or illiquid markets. FOK orders help avoid partial fills. However, they may result in missed opportunities if the order cannot be executed in its entirety.

How Multi Order Types Enhance Trading Strategies

- Precision Execution: By using a combination of order types, traders can precisely control their entry and exit points, optimizing their strategies for different market conditions.

- Risk Management: Stop orders and trailing stops allow traders to automate risk management, reducing the emotional stress of trading and ensuring that losses are kept within acceptable limits.

- Maximizing Profit Opportunities: Limit orders and trailing stops help traders capture favorable price movements while minimizing the risk of adverse market conditions.

- Flexibility and Adaptability: The availability of multiple order types allows traders to adapt their strategies to suit the current market environment, whether they are dealing with high volatility, low liquidity, or steady trends.

Multi order types are fundamental in trading on Centralized Exchanges. They offer traders the tools needed to execute strategies with precision and confidence. By understanding and using these order types effectively, traders can manage risk better. They can also maximize profits and navigate the complexities of financial markets.

PadiTech develop advanced trading platforms that support a wide range of order types, enabling traders to implement sophisticated strategies with ease. Our solutions are designed to deliver fast execution, reliability, and the flexibility needed to thrive in today’s competitive trading environment. Partner with PadiTech to equip your trading platform with the features and performance necessary to meet the demands of modern traders.

High Performance Trading Engine in CEX

In the fast-paced world of Centralized Exchanges (CEX), the trading engine is the backbone that ensures smooth and efficient trading operations. As the volume and complexity of trades increase, the need for a high-performance trading engine becomes critical.

What is a High-Performance Trading Engine?

A high-performance trading engine is a sophisticated software system designed to process a large number of transactions quickly and accurately. In a CEX, this engine matches buy and sell orders. It manages the order book and ensures efficient trade execution. The trading engine must handle a high volume of trades. It must do so with minimal latency to meet the demands of both institutional and retail traders.

Key Features of High-Performance Trading Engines

Low Latency

In trading, speed is crucial. Low latency ensures that orders are executed in real-time, minimizing the risk of slippage and enabling traders to take advantage of market opportunities as they arise. This is achieved through optimized algorithms and infrastructure that can process orders in microseconds, ensuring that traders receive the best possible prices.

Scalability

As trading volumes increase, especially during market surges, the trading engine must scale to meet higher demand. It must do this without compromising performance. Scalability is achieved through distributed computing and cloud-based solutions. These technologies allow the engine to handle millions of transactions per second (TPS) without delays.

Robust Order Matching

Accurate and efficient order matching is vital for maintaining market integrity and ensuring that all participants are treated fairly. Advanced matching algorithms ensure that orders are matched accurately, prioritizing price and time to fulfill trades in the best interest of both buyers and sellers.

High Throughput

High throughput is essential for processing a large number of trades simultaneously, especially during peak trading times. By leveraging multi-threading and parallel processing, the engine can handle a high volume of orders without bottlenecks, ensuring that all trades are processed promptly.

Resilience and Fault Tolerance

In the event of system failures or unexpected issues, the trading engine must be able to recover quickly to prevent trading disruptions. Redundant systems and failover mechanisms ensure that the engine remains operational even in the face of hardware or software failures, maintaining continuous trading operations.

Impact on Trading Experience

A high-performance trading engine significantly enhances the trading experience on a CEX:

- Improved User Confidence: Fast and reliable trade execution builds trust among traders, encouraging more participation and increasing trading volumes.

- Liquidity Enhancement: Efficient order matching and execution contribute to deeper liquidity, making it easier for traders to enter and exit positions at their desired prices.

- Market Stability: A robust trading engine helps maintain market stability by handling large volumes of trades without glitches, reducing the likelihood of market manipulation or flash crashes.

Understanding and utilizing multi order types is essential for any trader looking to optimize their trading strategy. These order types provide essential tools to navigate financial markets. They offer flexibility, control, and enhanced risk management. Whether you are a novice trader or an experienced professional, mastering multi order types is crucial. This skill can significantly improve your trading performance.

At PadiTech, we develop trading platforms that support a wide range of order types, empowering traders with the tools they need to succeed in today’s competitive markets. Our solutions are designed to provide fast execution, reliability, and the flexibility to implement advanced trading strategies with ease.

E-Wallet Development: Key Features and Essentials

E-wallets combine secure storage and payment gateways, enabling online transactions via computers or smartphones. They function similarly to debit or credit cards but are entirely digital, eliminating the need for physical wallets.

How does this model work for merchants, startups, or FinTechs entering the market? Let’s explore the main types:

- Closed Wallets: Users can only transact with the wallet issuer, such as Amazon Pay. Funds from returns, refunds, or cancellations are stored within the wallet. This model benefits companies selling products or services, sometimes allowing them to earn interest on wallet balances.

- Semi-Closed Wallets: This option offers more flexibility, enabling transactions at specific stores and locations, like PayPal. These platforms centrally manage e-money for online and offline purchases, often requiring an e-money license to emit virtual currency into users’ wallets.

- Open Wallets: Typically developed by banks or in partnership with them, this model, like Visa or Mastercard, is widely accepted by retailers. It includes features of semi-closed wallets, supports online purchases, contactless in-store payments, and allows fund withdrawals at select ATMs or locations.

Key Components of E-wallet Development

Multi-Currencies

Modern e-wallets need to support multiple currencies to cater to a global user base. Multi-currency functionality allows users to hold and manage different types of digital and fiat currencies within a single wallet.

- Flexibility: Supporting various currencies enhances the wallet’s usability for international transactions. Users can store and transact in their preferred currency without the need for conversion.

- Conversion and Exchange: Integrating real-time exchange rates and conversion tools within the wallet can facilitate seamless currency swaps and transactions across different currencies.

- Regulatory Compliance: Ensuring compliance with international financial regulations and standards is crucial when dealing with multiple currencies. The e-wallet must adhere to legal requirements in different regions.

Multi-Platforms

To maximize accessibility and user convenience, e-wallets should be developed for multiple platforms. This includes:

- Mobile Applications: E-wallets are predominantly used on mobile devices. Developing native apps for both iOS and Android ensures a smooth and optimized user experience.

- Web Applications: A web-based version of the e-wallet allows users to access their wallet from any browser, providing flexibility and convenience.

- Desktop Applications: For users who prefer desktop access, developing a desktop version can enhance the wallet’s versatility and cater to different user preferences.

Client-Side Private Key Storage

Security is a top priority in e-wallet development, and client-side private key storage is a critical aspect:

- Enhanced Security: Storing private keys on the client-side ensures that sensitive information is kept secure and not exposed to potential breaches on server-side storage.

- User Control: By managing private keys locally, users maintain complete control over their assets, reducing the risk of unauthorized access.

- Encryption: Implementing robust encryption methods to protect private keys is essential. Encryption ensures that even if the device is compromised, the private keys remain secure.

Push Notifications

Push notifications play a vital role in enhancing the user experience and keeping users informed:

- Transaction Alerts: Notify users of important events such as successful transactions, failed payments, or security alerts. This helps users stay informed about their account activities.

- Promotional Notifications: Engage users with promotions, updates, or new features through targeted notifications. This can boost user engagement and retention.

- Real-Time Updates: Providing real-time updates on transaction status and account changes ensures users are always up-to-date with their wallet activities.

Developing a robust and efficient e-wallet involves addressing several key components to ensure functionality, security, and user satisfaction. By incorporating multi-currency support, multi-platform access, client-side private key storage, and effective push notifications, developers can create a comprehensive e-wallet solution that meets the diverse needs of users.

At PadiTech, we specialize in E-wallet development, delivering solutions that integrate these essential features to enhance user experience and security. Our expertise in developing multi-currency support, cross-platform applications, and secure private key storage ensures that your e-wallet meets the highest standards of performance and reliability. Partner with PadiTech to bring your e-wallet vision to life and provide a seamless digital financial experience for your users.

High Performance Trading Engine in DEX

In the world of decentralized exchanges (DEX), the trading engine is the core component that ensures smooth and efficient trading operations. A high-performance trading engine is crucial for handling the complexities of trading in a decentralized environment. This article delves into the significance of high-performance trading engines in DEX, their key features, and their impact on the trading experience.

What is a High-Performance Trading Engine?

A high-performance trading engine is a sophisticated software system designed to handle a large volume of trading activity with minimal latency. In the context of a DEX, it is responsible for matching buy and sell orders, managing order books, and executing trades. The engine ensures that trades are executed quickly and accurately, even under high trading volumes.

Key Features of High-Performance Trading Engines

- Low Latency: Speed is paramount in trading. A high-performance trading engine minimizes latency to ensure that orders are processed and executed in real-time. This is crucial for traders who rely on timely execution to capitalize on market opportunities.

- Scalability: The trading engine must be able to scale seamlessly with increasing trading volumes. As the number of users and trades on a DEX grows, the engine should handle the increased load without degradation in performance.

- Robust Order Matching: Efficient order matching is essential for a smooth trading experience. A high-performance trading engine matches buy and sell orders quickly and accurately, ensuring fair and transparent trading.

- Advanced Order Types: The engine supports various order types, including limit orders, market orders, and stop orders. This flexibility allows traders to implement different trading strategies effectively.

- High Throughput: The engine should be capable of processing a high number of transactions per second (TPS). High throughput ensures that the trading platform remains responsive and reliable even during periods of intense trading activity.

- Fault Tolerance: Reliability is critical. A high-performance trading engine must be resilient to failures and capable of recovering swiftly from any issues to prevent disruptions in trading.

Impact on the Trading Experience

A high-performance trading engine directly influences the trading experience on a DEX. Here’s how:

- Enhanced User Experience: With low latency and high throughput, traders experience smooth and efficient trading. Quick execution of trades and reliable order matching contribute to a positive user experience.

- Increased Market Liquidity: Efficient order matching and processing attract more traders to the platform. This increased activity leads to higher liquidity, making it easier for users to buy and sell assets at desired prices.

- Fair Trading Environment: A high-performance engine ensures that all trades are executed fairly and transparently. This builds trust among traders and encourages more participation in the market.

- Scalability and Growth: As the DEX attracts more users and trading activity grows, a scalable trading engine supports the platform’s expansion without compromising performance. This scalability is essential for the long-term success of the exchange.

PadiTech’s Role in High-Performance Trading Engines

At PadiTech, we understand the critical role that high-performance trading engines play in the success of decentralized exchanges. Our team specializes in developing cutting-edge trading solutions that ensure low latency, high throughput, and robust scalability. By leveraging advanced technologies and our deep expertise, PadiTech delivers trading engines that enhance user experience, support market liquidity, and drive the growth of DEX platforms. Partner with PadiTech to empower your trading infrastructure and stay ahead in the rapidly evolving world of decentralized finance.

Sidechain & Features

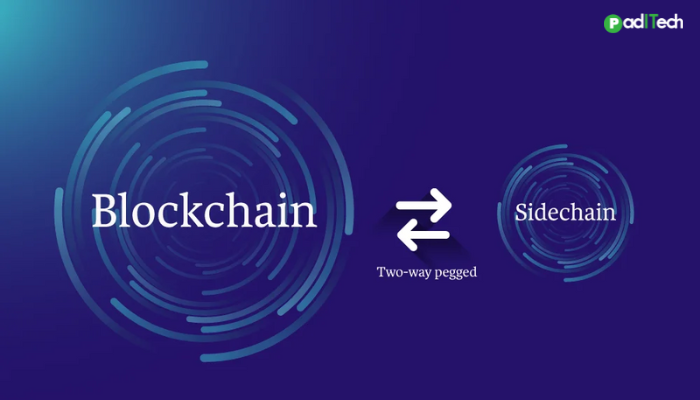

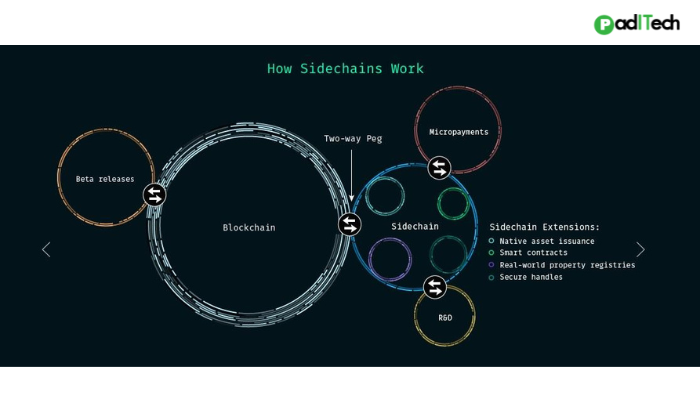

A sidechain in blockchain is an independent blockchain that operates alongside a parent blockchain (mainchain) and is connected to it via a two-way peg.

This connection allows assets to be transferred securely and efficiently between the mainchain and the sidechain. Here’s a detailed look at the concept:

Key Features of Side Chains:

Two-Way Peg:

The two-way peg mechanism enables assets to move from the mainchain to the sidechain and vice versa at a fixed exchange rate, ensuring the value of assets is maintained across chains.

Independence

Sidechains operate independently from the mainchain, meaning they can have their own consensus mechanisms, governance models, and set of rules.

Enhanced Functionality

Sidechains can implement different features and functionalities that may not be feasible or desirable on the mainchain. This includes experimenting with new technologies, consensus algorithms, or transaction types.

Advantages of Sidechains

Scalability: Sidechains address the scalability challenges of main blockchains by independently processing a subset of transactions. This leads to faster transaction speeds and increased throughput.

Customizable Functionality: Sidechains provide developers with the flexibility to experiment and implement custom features, smart contracts, and consensus mechanisms tailored to specific use cases. This allows for specialized solutions without compromising the main blockchain’s stability and consensus protocols.

Interoperability: By maintaining a connection to the main blockchain, sidechains facilitate the seamless transfer of assets between chains. This interoperability enables cross-chain interactions, allowing smooth integration with decentralized applications (dApps) and other blockchain networks.

Enhanced Privacy: Sidechains can incorporate advanced privacy features, such as zero-knowledge proofs or ring signatures, to strengthen the confidentiality of transactions and safeguard user data.

Future of Blockchain Sidechains

With Ethereum 2.0 and the Merge on the horizon, Layer 2 scaling solutions have emerged as crucial for alleviating the Ethereum network’s congestion. Amid this, sidechains pose an intriguing question: can they claim a share of the scalability landscape? What lies ahead for sidechains?

Scaling solutions can be categorized into five main architectural approaches: Sidechains, State Channels, Plasma, Rollups (both Optimistic and Zero-Knowledge), and Validium. Currently, Layer 2 solutions employing rollups seem to dominate in terms of project adoption.

While still in their early stages, sidechains face an uphill battle due to inherent limitations, particularly in security and data availability. These weaknesses render sidechains less appealing compared to rollup-based or validium solutions, casting doubt on their potential to significantly impact the scalability race.

Unlimited Scaling: Breaking the Boundaries of Expansion

Unlimited Scaling is a concept that refers to the ability of a system, application, or network to scale its operations infinitely without encountering any limitations in performance or responsiveness. In other words, this system can handle an unlimited increase in data volume, number of users, or other demands without slowing down or crashing.

Why is Unlimited Scaling important?

- Meeting Growth Demands: In the digital age, the demand for online services and applications is growing rapidly. The ability to scale ensures that systems can always meet user needs, even during sudden spikes like large promotions or special events.

- Improving Performance: A scalable system maintains stable performance even as traffic increases, ensuring the best possible user experience.

- Cost Efficiency: Instead of investing in an overly large system from the start, businesses can begin with a smaller system and gradually expand it according to their needs. This approach helps save on initial investment costs.

Unlimited Scaling refers to the ability of a system, application, or network to expand its operational scale indefinitely. It does this without encountering any performance or capacity limitations. In other words, it can handle an unlimited increase in data volume, user numbers, or other demands. This capability ensures that the system does not slow down or crash.

To help you make a well-informed decision about scaling your system, PadiTech has compiled a list of potential challenges that you may face.

Challenges and Considerations

While unlimited scaling is an ideal, achieving it in practice presents several challenges:

Network Latency: As systems grow larger, network latency can become a bottleneck.

Data Consistency: Maintaining data consistency across multiple nodes can be complex.

Cost: Scaling infrastructure can be expensive, especially for large-scale systems.

Complexity: Managing and operating complex, distributed systems requires specialized expertise.

Real-World Examples of Unlimited Scaling

Cloud Computing Platforms: Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure are prime examples of systems designed for unlimited scaling.

Content Delivery Networks (CDNs): These networks distribute content across multiple servers to ensure fast delivery to users worldwide.

Social Media Platforms: Platforms like Facebook and Twitter must handle massive user loads and data volumes, requiring constant scaling.

Online Gaming: Online games often experience peak loads during specific times, necessitating scalable infrastructure.

Future Trends in Unlimited Scaling

Edge Computing: Bringing computation and data storage closer to users for faster response times and reduced network congestion.

Serverless Computing: Automating infrastructure management and scaling based on demand.

AI-Driven Optimization: Using AI to predict and manage workload fluctuations for efficient scaling.

古い投稿ページへ